Table of Contents

Bankruptcy can be a lifeline for those drowning in debt, a fresh start amidst financial turmoil. However, the legal complexities of the process can be overwhelming, leaving many feeling lost. A bankruptcy trustee can serve as a guide to bankruptcy proceedings, ensuring a smooth journey toward financial recovery.

At Brown, Bass & Jeter, we understand the emotional and financial strain filing for bankruptcy can cause. Our seasoned Mississippi bankruptcy attorneys have witnessed firsthand the transformative power of this legal tool, helping countless clients relieve the burden of debt and rebuild their lives.

In this comprehensive guide, we’ll highlight the pivotal role of the bankruptcy trustee, analyzing their responsibilities within the bankruptcy system and explaining how they can help you in your pursuit of a brighter financial future.

Our goal is to equip you with the knowledge and resources necessary to enter bankruptcy confidently, make informed decisions about your financial affairs, and come out the other side with newfound financial freedom.

Bankruptcy Statistics in the U.S.

Bankruptcy is more common than you might think. Financial hardship can affect anyone, regardless of income or background. According to statistics from the American Bankruptcy Institute, there were 45,592 bankruptcy filings in April of 2024 alone, a 28% increase compared to the same period in 2023.

This surge wasn’t limited to individuals — commercial filings also rose substantially, with Chapter 11 filings increasing by 39% and Subchapter V small business elections increasing by an alarming 60%.

These figures paint a stark picture of the financial challenges facing both individuals and businesses. They also underscore the importance of understanding bankruptcy as a potential solution and the crucial role the bankruptcy trustee plays in the process.

Overwhelmed by Debt?

Don't struggle under the weight of your debt alone. Brown, Bass & Jeter's experienced bankruptcy attorneys can help you file for bankruptcy and guide you toward a fresh start. Contact us today!

What Is a Bankruptcy Trustee?

A bankruptcy trustee is a court-appointed officer responsible for administering a bankruptcy case.

Sections 345 and 348 of Title 11 of the U.S. Code spell out the trustee’s role, which extends far beyond that of a mere referee. Essentially, they’re the investigators, administrators, and guardians of the bankruptcy estate. Their primary objective is to ensure fairness and equity for both the debtor and their creditors.

The trustee is a fundamental component of the bankruptcy system. They’re appointed by the United States Trustee Program, a division of the Department of Justice, to oversee various aspects of the process.

The Importance of the Bankruptcy Trustee

Understanding the multi-faceted role of the bankruptcy trustee is essential for anyone considering bankruptcy.

The trustee’s commitment to fairness, transparency, and the efficient administration of the bankruptcy estate is crucial for ensuring a just outcome for all parties involved. Their duties, which are outlined in the bankruptcy code, include investigating the debtor’s financial affairs, administering the bankruptcy estate, and distributing the estate’s assets to creditors.

Whether you’re a debtor seeking relief and a fresh financial start through Chapter 7 or Chapter 13 bankruptcy or a creditor seeking to recover what you’re owed, the bankruptcy trustee will play a pivotal role in upholding the integrity of the system and protecting your interests.

The Bankruptcy Trustee’s Duties as Investigator

When you file for bankruptcy, one of the trustee’s key responsibilities will be to thoroughly investigate your financial affairs. This in-depth examination aims to accomplish the following:

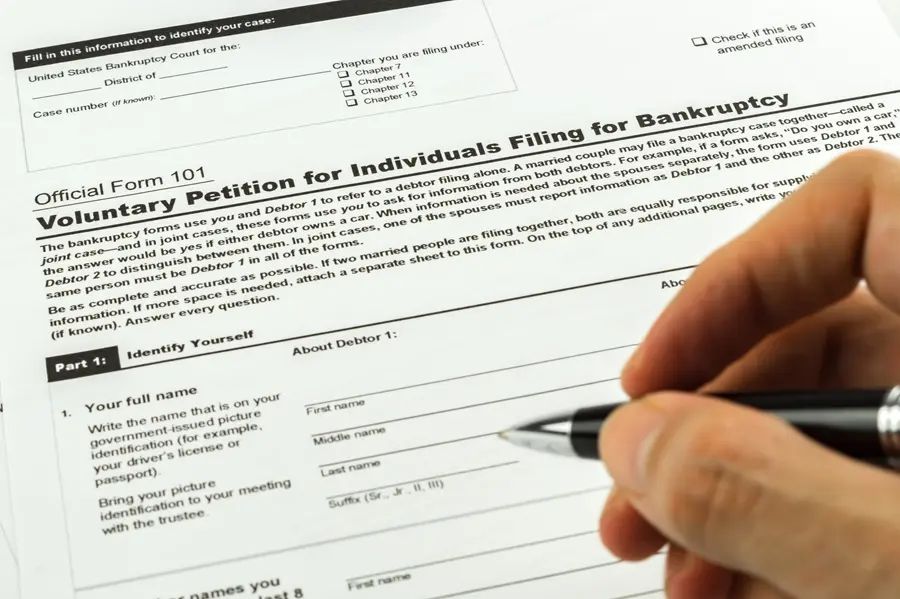

Verify the Accuracy of Your Bankruptcy Petition

The trustee will scrutinize your financial records — including bank statements, tax returns, property deeds, investment accounts, retirement accounts, and any other relevant documents — to ensure that all assets and liabilities are accurately disclosed.

Identify Any Undisclosed Assets or Fraudulent Activities

The trustee will be diligent in uncovering any attempts to conceal assets or engage in fraudulent practices. This may include investigating property transfers, preferential payments to creditors, and inconsistencies in financial records.

Assess Your Overall Financial Situation

The trustee may conduct interviews, request additional documentation, and even visit your home or business to gain a better understanding of your financial circumstances. Doing so will help them determine the best course of action for your case.

By meticulously reviewing financial records and actively seeking out hidden assets or fraudulent activities, the trustee ensures that all parties are treated equitably and that the bankruptcy process proceeds smoothly and transparently.

The Bankruptcy Trustee’s Duties as Administrator and Guardian

Beyond investigation, the trustee also serves as the administrator of the bankruptcy estate. In this function, they collect and liquidate non-exempt assets, review claims filed by creditors, object to invalid claims, and distribute proceeds to creditors in accordance with the bankruptcy code.

In Chapter 13 bankruptcy cases, the trustee’s role extends to overseeing the debtor’s repayment plan. They collect monthly payments and disburse them to creditors according to the terms of the plan.

What a Bankruptcy Trustee Can’t Do

Bankruptcy trustees have significant responsibilities and powers, but they’re also subject to certain limitations. Here are some of the things bankruptcy trustees can’t do:

Act in Their Own Interest

The most fundamental restriction on trustees is that they must act solely in the interests of the estate and its creditors, not their own. This means they can’t prioritize personal gain or benefit from the bankruptcy process.

Engage in Conflicts of Interest

Trustees also can’t have any financial or personal relationships that could create a conflict of interest. They’re not allowed to represent creditors they have a personal connection with or use their position to benefit themselves or their associates in any way.

Discriminate Against Creditors

Trustees must treat all creditors fairly and equitably. In other words, they can’t favor certain creditors over others based on personal preferences or biases.

Improperly Dispose of Assets

Trustees must manage the debtor’s assets responsibly and according to established legal principles. They can’t sell assets for less than fair market value or engage in improper transactions that benefit themselves or others at the expense of the estate.

Disregard Court Orders

Trustees must comply with all court orders and rulings related to the bankruptcy case. They can’t ignore instructions or act outside of the court’s authority.

Violate Bankruptcy Law

Trustees must adhere to all applicable bankruptcy laws and regulations. This includes following specific procedures for managing the estate, reporting to the court, and distributing funds to creditors.

Make Unauthorized Payments

Trustees can’t make payments outside of the approved bankruptcy plan or distribute funds to creditors without proper authorization.

Interfere with the Debtor’s Rights

Trustees can’t unduly interfere with the debtor’s rights, such as their right to privacy or their right to seek legal counsel. This restriction goes back to acting in the debtor’s best interests.

Take Unnecessary Action

Trustees must act reasonably and prudently. They can’t take unnecessary or costly actions that don’t offer a clear benefit to the estate or its creditors.

Disclose Confidential Information

Trustees have access to sensitive and confidential information about the debtor’s finances and personal life. They can’t disclose this information to unauthorized individuals or use it for personal gain.

Do I Have a Choice in Selecting My Trustee?

While the trustee plays a central role in bankruptcy proceedings, the level of involvement you have in selecting them depends on the specific chapter of bankruptcy you’re filing for.

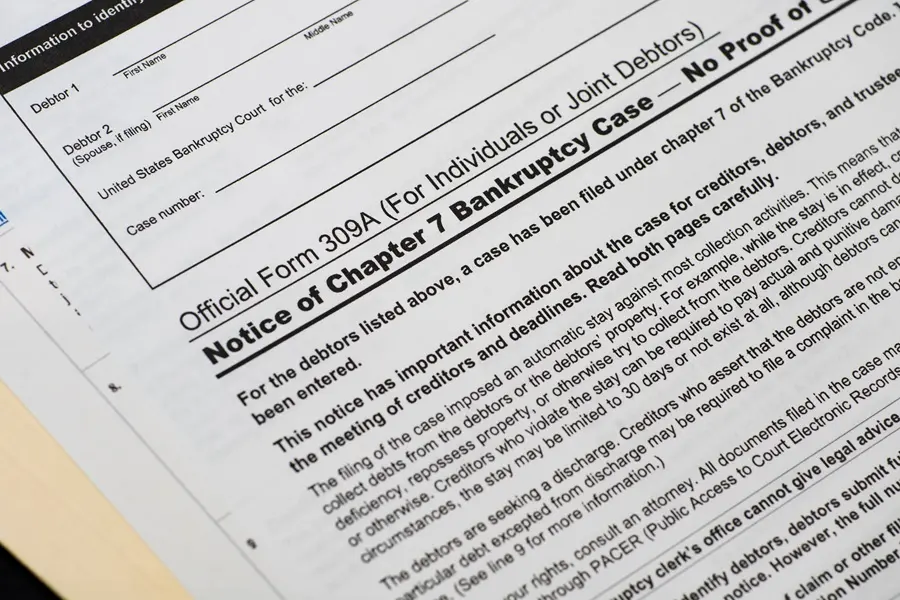

Chapter 7 Bankruptcy

In a Chapter 7 case, where the goal is to liquidate assets and distribute the proceeds to creditors, the trustee is generally appointed by either the U.S. Trustee Program or directly by the bankruptcy court.

The Trustee Program uses a rotation system to assign trustees based on the location of the bankruptcy case. This ensures that trustees are assigned fairly and impartially and have experience handling cases in a given region.

Chapter 11 Bankruptcy

Chapter 11 involves a business or individual attempting to restructure their debts and continue operating. Here, you might have a bit more influence in the trustee selection process.

As the debtor, you can propose a trustee in your plan, but the court will make the final decision as to whether the individual you name is suitable. The court will consider factors like the trustee’s experience, expertise in managing similar businesses, and potential conflicts of interest.

Chapter 13 Bankruptcy

Chapter 13 deals with individuals creating plans to repay their debts over a specific period. In this case, you have no say in selecting your trustee. They’ll be appointed by the court, which will consider factors like the trustee’s experience with Chapter 13 cases and their ability to administer the repayment plan fairly.

Important Considerations

Regardless of the type of bankruptcy you file for, it’s important to understand that the trustee acts as an independent party — they represent the interests of all parties involved, not just the debtor. You must trust your trustee and their decisions, as they have considerable authority over managing assets and distributing funds.

If you have any concerns about your appointed trustee, it’s recommended that you discuss them with a qualified bankruptcy attorney. Your attorney can help you understand the trustee’s role and advocate for your interests if necessary.

Does Every Bankruptcy Case Require a Trustee?

Trustees aren’t required for all bankruptcy proceedings. Their need depends on the specific chapter under which the debtor files.

Here’s a breakdown of the different chapters and whether a trustee will be assigned to oversee the case:

- Chapter 7 bankruptcy: A trustee is required.

- Chapter 11 bankruptcy: A trustee isn’t usually required; however, the court may appoint one in certain situations, such as:

- If the debtor isn’t trustworthy or lacks the means to manage the business.

- If creditors request a trustee due to concerns about the debtor’s competence.

- If the court believes a trustee is necessary to protect creditors’ interests.

- Chapter 13 bankruptcy: A trustee is required.

Even if you have minimal assets or debts, the trustee will still play a vital role. Among other things, they’ll ensure that all necessary paperwork is filed correctly, verify the accuracy of the financial information you provide in the bankruptcy petition (including your income and expenses), and preside over the meeting of creditors, also known as the 341 meeting.

Trustees in Chapter 7 Bankruptcy: Liquidation

In Chapter 7 bankruptcy, often referred to as liquidation bankruptcy, the trustee takes charge of your non-exempt assets (those not protected by state or federal bankruptcy exemptions), which could include real estate, vehicles, investments, business interests, or even valuable personal belongings.

The trustee will meticulously identify and evaluate these assets, then liquidate (sell) them to generate funds. These funds will then be distributed among your unsecured creditors based on the priority of their claims as outlined in the bankruptcy code.

The trustee’s role doesn’t end there, however. They’ll ensure that you adhere to all legal obligations and procedures throughout the process, such as attending the meeting of creditors, which gives your creditors an opportunity to ask questions about your finances and the bankruptcy process.

Trustees in Chapter 11 Bankruptcy: Reorganization

Chapter 11 is primarily designed for businesses seeking to restructure their debts and operations to remain viable. In this instance, the trustee plays a supervisory role, overseeing the debtor’s efforts to formulate a feasible reorganization plan.

This plan, which is subject to court approval, will outline how you intend to repay your debts over time. Depending on your situation, repaying your debts may require you to adjust your business operations, restructure your debt, and negotiate with your creditors.

The trustee will act as a mediator between you and your creditors during this process, ensuring that the plan is fair and equitable and satisfies bankruptcy code provisions. They may also be involved in operating the business during reorganization if the court deems it necessary.

Trustees in Chapter 13 Bankruptcy: Repayment Plan

Chapter 13 bankruptcy allows individuals with regular income to propose a repayment plan to catch up on missed payments and settle their debts over a three-to-five-year period. A trustee is indispensable for this process. They’re responsible for collecting your monthly payments and disbursing them to your creditors based on the terms outlined in the approved plan.

The repayment plan is subject to the court’s approval. It must satisfy the “best interests of creditors” test to ensure that unsecured creditors receive at least as much as they would have in a Chapter 7 liquidation.

The trustee also monitors compliance with the plan, taking action if you miss payments or violate the terms. Additionally, they may intervene if disputes arise between you and your creditors regarding the plan. They’ll also file reports with the bankruptcy court regarding your progress and compliance.

As you can see, a bankruptcy trustee must be adaptable to fulfill the duties of the specific chapter of bankruptcy a debtor files, acting as an authority in each scenario.

Need Debt Relief?

The experienced bankruptcy lawyers at Brown, Bass & Jeter can help you explore your options and protect your rights. Schedule a free consultation today!

How Are Bankruptcy Trustees Paid?

Bankruptcy trustees are compensated for their services and expenses from the debtor’s estate, not directly by the debtor. Their compensation is structured to ensure fairness and transparency.

Fees

The Bankruptcy Code (11 U.S. Code §330) outlines the percentage of the estate’s value that trustees are entitled to receive as their fee.

This percentage isn’t fixed but varies based on factors like the size of the estate and the complexity of the case — a complicated case might justify a higher percentage fee. The goal is to incentivize trustees to efficiently manage the estate while making sure they’re adequately compensated for their efforts.

Expenses

Beyond their base fees, trustees are also reimbursed for reasonable expenses incurred while fulfilling their duties. This can include travel costs for attending meetings and court appearances, legal fees for professional advice, and administrative costs for managing the estate’s finances.

The bankruptcy court will scrutinize these expenses to confirm that they’re legitimate and necessary for the effective administration of the case.

Compensation Limits

To prevent excessive compensation, the Bankruptcy Code also sets limits on the total amount a trustee can receive for their fees and expenses. These limits are periodically adjusted to reflect changes in the economy and ensure that compensation remains fair and reasonable.

Source of Payment

The trustee’s fees and expenses are paid directly from the debtor’s estate, which means they’re drawn from the assets of the person or business filing for bankruptcy. This arrangement is intended to be equitable, as the trustee’s compensation comes from the very assets they’re managing and distributing.

It’s important to remember that the trustee’s compensation is ultimately a reflection of the work they put into managing the estate and fulfilling their responsibilities to creditors. Their payment is subject to oversight and review by the court, guaranteeing that it remains within acceptable parameters and contributes to the overall success of the bankruptcy process.

Start the Path to Financial Recovery

Whether you’re a debtor seeking a fresh start or a creditor trying to recover what you’re owed, understanding the role bankruptcy trustees play in the bankruptcy process is vital.

These officers act as impartial overseers, promoting fairness and transparency for both debtors and creditors. Their duties vary depending on the chapter filed, but their core responsibility remains consistent: to uphold the integrity of the bankruptcy system and facilitate the best possible outcome for all parties involved.

The knowledgeable bankruptcy, personal injury, and auto accident lawyers at Brown, Bass & Jeter are dedicated to providing personalized and compassionate legal representation to clients navigating this challenging process.

Whether you need assistance filing for bankruptcy, protecting your assets, or negotiating with creditors, we’re here to advocate for your interests every step of the way. Contact us today to schedule a free consultation, and let us help you secure your future.